With the new rules on GST invoicing applying from 1 April 2023, ‘taxable supply information’ is effectively replacing tax invoices and must be retained and able to be provided.

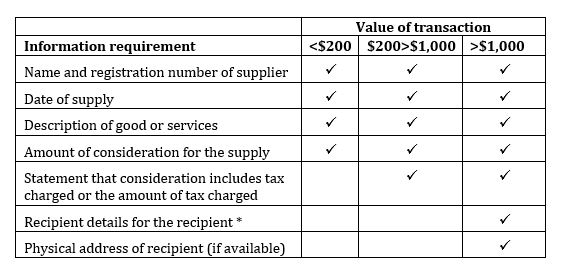

The information required is dependent on the value of the transaction.

*Recipient details require the name of the recipient and one or more of the following:

- Address of a physical location

- Telephone number

- Email address

- Trading name other than the name of the recipient

- New Zealand business number (NZBN)

- Website address

Requirements around credit and debit notes are similarly revised. Formal GST credit and debit notes will no longer be required, however information known as ‘supply correction information’ must be retained. This includes information on inaccuracies corrected such as incorrect descriptions of goods or services, places/times of supply or suppliers/customers.

You must provide supply correction information where the taxable supply information previously provided to a recipient has an incorrect amount of GST, or where you included the incorrect amount of output tax in a GST return. You must provide this information by a date agreed between you and the recipient, or if no date is agreed, within 28 days of the date of the taxable supply information that contained the mistake.

Where the GST shown in the taxable supply information is greater than the eventual GST charged due to a prompt payment discount or an agreed discount which are part of usual business terms, you won’t have to provide the supply correction information.

Call us for more detail.