Engine Room Chartered Accountants provide strategic accountancy + business advisory services to excel business growth and performance.

Our latest insights

-

Mind the Productivity Gap – Why we need to work smarter, not harder

Running an SME in New Zealand often means juggling a thousand tasks—and still not feeling like there’s enough hours in the day. That gap between what you need to get done…

-

Can you afford to be complacent with digital capability?

If the past few years taught us anything, it’s that digital tools aren’t a “nice-to-have” anymore—they’re the backbone of a resilient business. Yet far too many Kiwi businesses are still…

-

Exit Strategy 101: Preparing your Business for What Comes Next

Thinking about exiting your business doesn’t mean the journey’s over—it signals a new chapter. A well‑crafted exit strategy ensures your legacy lives on, your team stays solid, and your business…

-

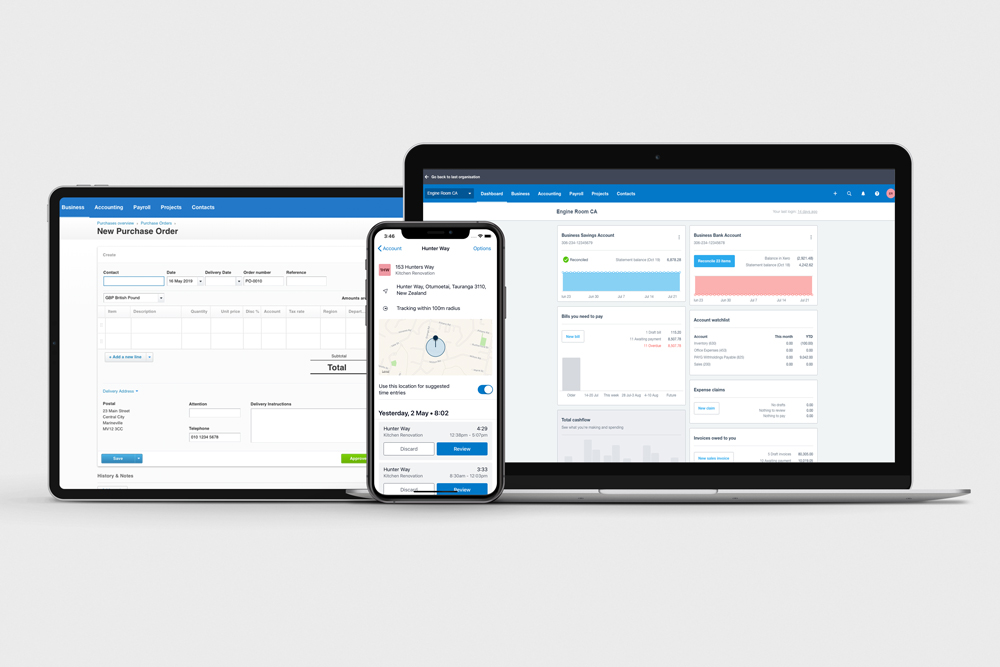

How to make Xero work harder for you

With Xero subscriptions in New Zealand increasing from September, its prompted a moment of reflection: Am I getting the most out of what I’m paying for? There is a positive…